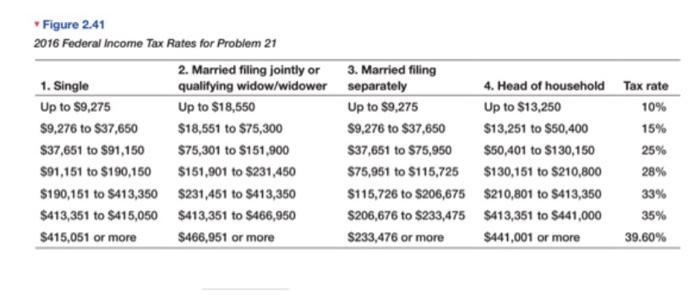

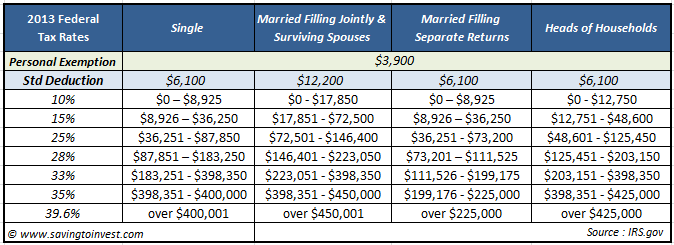

2013 Tax Rates and Brackets, Standard Deduction and Personal Exemptions Updated in Federal IRS Tax Table | $aving to Invest

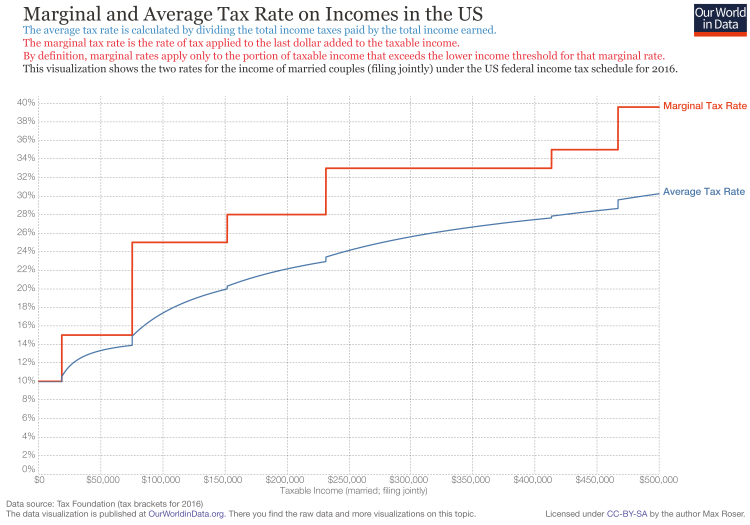

T16-0091 - Average Effective Federal Tax Rates -- All Tax Units By Expanded Cash Income Level, 2016 | Tax Policy Center

T17-0040 - Average Effective Federal Tax Rates - All Tax Units, By Expanded Cash Income Income Percentile, 2016 | Tax Policy Center

T16-0092 - Average Effective Federal Tax Rates - All Tax Units By Expanded Cash Income Percentile, 2016 | Tax Policy Center

united states - What is meant by one being in a "tax bracket"? - Personal Finance & Money Stack Exchange